Let’s rewind the tape for a moment. Since I started traveling I have tried to seek out experiences that are different from the norm. One-of-a-kind journies that push the limits and make you a little uncomfortable. All while exploring some of the most interesting places on the planet.

This is about a lesson learned, an epic trip that was almost ruined by a mishap, and how you can protect yourself by learning from my mistakes.

Let’s dive in.

Why Vietnam

After zipping through Thailand and bouncing around the Balkans, I heard legends of an epic motorbike quest across Vietnam. Hanoi to Ho Chi Minh City—it was the kind of challenge that made my heart skip a beat. I vividly remember telling a friend of my Mom’s that I was going. her response nearly made me fall over, “I would never let MY son do that.”

I was definitely going.

The stunning views along the way and the cultural immersion from riding a motorbike from one side of a country to another couldn’t be undersold.

From Sapa to Phong Nha. HaLong Bay to Hue and so many more adventures awaited in Vietnam.

Prep work for the trip like finding insurance? Eh, I skimmed a blog post or two and figured, “How hard could it be?” The risks were like fine print—I knew they were there, but I didn’t pay much attention. But hey, I wasn’t totally reckless; I made some plans, bought a few things, and I got some travel insurance from a company called World Nomads, thinking I was all set. I had read reviews from their coverage online and assumed they were going to have my back in an emergency.

I rented a bike from Tigit Motorbikes in Hanoi to kick the journey off. The bike they gave me was more old-school manual than the semi-auto I was used to. But, I figured, “I got this.”

Spoiler alert: I did not, in fact, “got this.”

The Day Things Went Wrong

So, I’m cruising down Vietnam’s famous Hai Van Pass. I was flying down the highway, assuming it’s a nicely paved road that I was perfectly safe. I went through a tunnel and came out the other side to a mesmerizing view of the landscape. A semi was passing me on my left momentarily blocking the beautiful views when I glanced back to the road.

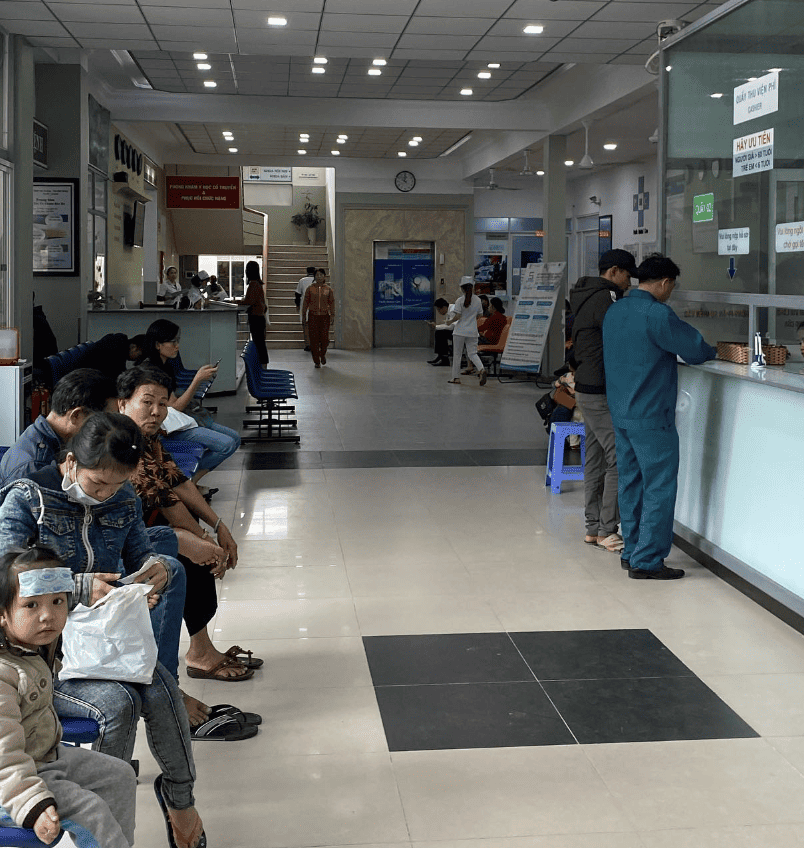

Shock. Pain. The world turned into a spin cycle as I tumbled across the pavement. When I hit the road I shredded my riding jacket and pants. My first thought was if my leg was broken as it hurt to stand. Some locals quickly stopped to help me clean up the mess and get me to a local repair shop. I was concussed, bloody, and in bad shape. I finally found a ride a few hours later to the hospital in Hoi An to see how bad the damage was and to recover.

After almost 10 days in and out of the hospital, getting bandages changed, and X-rays done to make sure I was alright I was able to continue on my journey. No more bike for me as I couldn’t extend my arm very far and needed to keep the bandages in place. Sigh…at least I had no major wounds but my bike adventure was over.

The open road was replaced with bus tickets and crammed local train rides.

The Not-So-Super Experience

Remember that insurance I was so confident about? World Nomads was a disappointment.” They ghosted after I sent them all my crash deets. Four years and countless “We’re on it” messages later, my bank account was as empty as their promises. It’s still sitting as an approved case on their site with no reimbursement for my medical bills.

I was stuck with a $800 bill for all my expenses in what I was told would be covered.

The bills themselves weren’t that bad as it was a local Vietnamese hospital but imagine if I had 10s of thousands in medical bills. Where would World Nomads be then?

This made me a bit more diligent in my insurance search process for the future.

This led me to a new company at the time, SafetyWing. Even though I was a little bitter about my previous experience when I was sick in Thailand, SafetyWing’s travel insurance came through with a reimbursement of my medical expenses with no real hassle.

Leveling Up: The Game-Changing SafetyWing Nomads Insurance 2.0

SafetyWing is like the buddy who actually shows up when you call for help. When I stumbled upon them, their branding and clear info won me over. No more blindly trusting my insurance for this guy.

Now I’m levelling up my safety game with something fresh off the travel press: SafetyWing Nomads Insurance 2.0. This isn’t just an update; it’s a total game-changer for those of us who live life a bit differently—maybe off a cliff, diving into azure waters, or cruising on a motorbike through a foreign country.

SafetyWing wasn’t there for my Vietnam faceplant, but they swooped in during a later crisis in Thailand. They are like a trusty sidekick, sorting out my bills without a hitch. Knowing they’ve got my back takes some anxiety off my plate knowing that if I have any issues I can count on them.

The Full SafetyWing Nomad Insurance Scoop

So, what’s the lowdown on SafetyWing Nomad Insurance 2.0? Let me paint you a picture:

Adventure Sports with SafetyWing? Covered! 🏍️

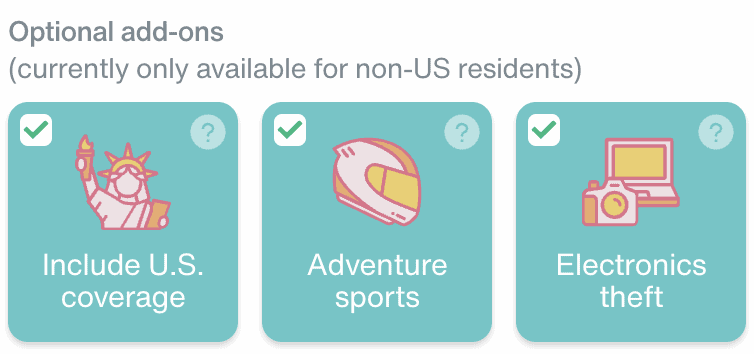

Imagine this: cave diving in Mexico’s cenotes, quad biking through the dunes of the Sahara, or swimming with the fishes—scuba style—in the Great Barrier Reef. Got that adrenaline pumping? Good. Because SafetyWing’s Nomads 2.0 has expanded its wings to cover over 30 adventure sports. Yep, including our beloved motorbikes (won’t let that happen again).

Thrills 🏅

SafetyWing now backs your daredevil spirit with coverage for those once-in-a-lifetime adventure sports. So whether you’re shredding trails on a mountain bike or free-falling from 10,000 feet, you’re in good hands.

Globe-Trotter Friendly 🌎

This insurance has got more reach than your favorite travel vlogger, with coverage in over 175 countries. No matter where your travels take you, they’re on the journey with you.

On Your Terms 🤝🏽

The real kicker? You call the shots on when your policy kicks in and when it taps out.

More Perks 🎉

They’ve even thrown in coverage for electronics theft, because they know our gadgets are our lifelines (and our offices).

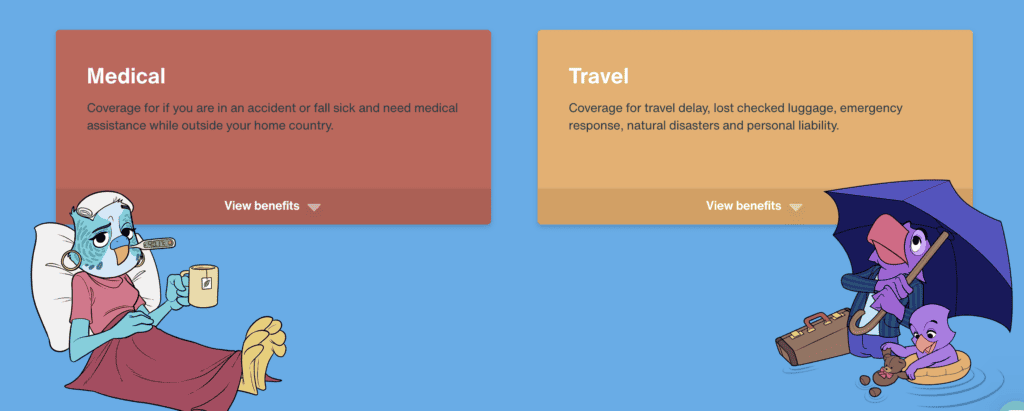

The SafetyWing Medical and Travel Insurance Lowdown:

Alright, I know insurance chat can be as dry as a week-old baguette, but stick with me. We’re talking about the kind of coverage that lets you leap into the unknown with a parachute.

A Claims Experience That Doesn’t Suck

We’ve all been there—filling out claim forms that feel like they need their own instruction manual. Well, SafetyWing must’ve heard our collective groans because they’ve gone full makeover mode on their claims process. It’s not just faster; it’s so user-friendly you might actually enjoy filling it out. Okay, maybe not enjoy, but definitely not dread!

The Nitty-Gritty Made Nifty

So, you’re out there, scaling mountains or navigating the urban jungles, and bam! You need a doctor, stat. Here’s how SafetyWing has your back:

Max Limit 💰

We’re talking a solid $250,000. That’s a quarter of a million reasons to feel secure. And for those seasoned adventurers over 65, a respectable $100,000 through WorldTrips policy.

Illness and Injury 🤒

Got knocked over by a rogue wave or came down with a case of the traveler’s tummy? They’ve got you covered, all the way up to your policy limit.

Medi-Evac 🚑

If you need to be whisked away to a hospital with more bells and whistles, they’ve earmarked up to $100,000 for it. Got a pre-existing condition? There’s still up to $25,000 on the table for you.

Emergency Dental 🦷

Because a toothache can strike faster than food poisoning from that sketchy street food stand. Up to $1,000 for acute onset of pain, provided you’re not grinning and bearing it for more than 24 hours.

Everything Else

They’re pretty comprehensive, so most other surprises are up to the overall max limit.

Health⚕️

- Your average sniffle, dental or a rogue tree branch injury? Check. Medically necessary treatments are in.

- Prescription drugs, ambulances, and emergency flights to fancy hospitals with shinier tools? Taken care of.

- What if your body decides home is where the heart wants to be treated? There’s a clause for that too!

Travel ✈️

- Missing luggage and passport heists are covered fast.

- Unplanned overnights and natural disaster relocations? Sure thing.

- And if an overseas pigeon steals your snacks and you’re hospitalized, they’ll even send some pocket money your way (hospital indemnity is a thing!).

Activities 🏄🏽♀️

- Like Indiana Jones, but with less boulder running? The standard package covers you for non-professional, non-competitive and properly safe adventures.

- But if you’re eyeing that bungee jump or fancy kite-surfing, there’s an add-on for the adrenaline junkie in you.

What Doesn’t Make the Cut

Now, not to be a buzzkill, but it’s not all-inclusive like that resort you’re eyeing in Cancun (please go somewhere else that’s less touristy.) High-flying acts like your cliff diving might not be under the umbrella, and that knee you busted playing college football won’t get a free pass. And cancer treatment, that’s a journey they don’t embark on.

Pre-existing conditions sneak in here again, along with chronic diseases like cancer.

Treatment that isn’t medically necessary (no spa treatments disguised as hydrotherapy, sorry).

If there’s a global warning out and you decide it’s a great time for a holiday, that’s a no-go and not covered.

Mental health disorders and addictions are serious stuff, but they’re not covered on this list.

Basically, if it’s not in the list of coverage, it’s not going to help you out.

Here’s the Endgame

Read the fine print like you’re deciphering the Da Vinci Code, seriously. Knowing what’s not covered is as crucial as knowing what is. SafetyWing Insurance is like that friend who’s got a couch ready for you in every city; it’s comforting, it’s there, but check the terms and conditions to know exactly how all encompassing their coverages.

Why This Matters

Imagine me, post-Vietnam motorbike flip—road rash and all. The last thing I want is my bank account taking a hit.. that’s where SafetyWing comes in, not just with the promise of protection, but with the bank to back it up.

You’re out there in the world chasing the sunset, and sure, the horizon is breathtaking, but it’s not gonna foot the bill if you take a spill. That’s why this coverage is clutch—it’s the guardian angel you didn’t know you needed, giving you one less “what if” to worry about.

The World is Your Oyster, But…

Here’s the deal: SafetyWing’s Nomad Insurance is like that all-access pass at a music festival. Most of the globe? Fair game. You can tango in Argentina, go on a safari in Kenya, or enjoy a midnight sun in Iceland. But—and it’s a big but—your home sweet home? That’s backstage, and you’re not on the list unless it’s a quick visit and even then, with a few caveats.

The Stars and Stripes Addendum

The land of the free, home of the brave, and the birthplace of deep-fried everything—yes, the United States. It’s tricky terrain for insurance, like trying to understand why Americans love baseball. If you want to chase those American dreams (with a safety net), you’ll need the USA add-on.

The Fine Print (No, It’s Not a Trap)

Here comes the part that sounds like it was written by someone who uses “henceforth” unironically: SafetyWing will cover you unless doling out those benefits would get them tangled in a web of UN sanctions or crosshairs of big-deal laws from the EU, UK, or USA, including Puerto Rico. In other words, they’re not about to play a high-stakes game of Risk with international regulators.

Let’s Talk Numbers: SafetyWing’s Sweet Deal

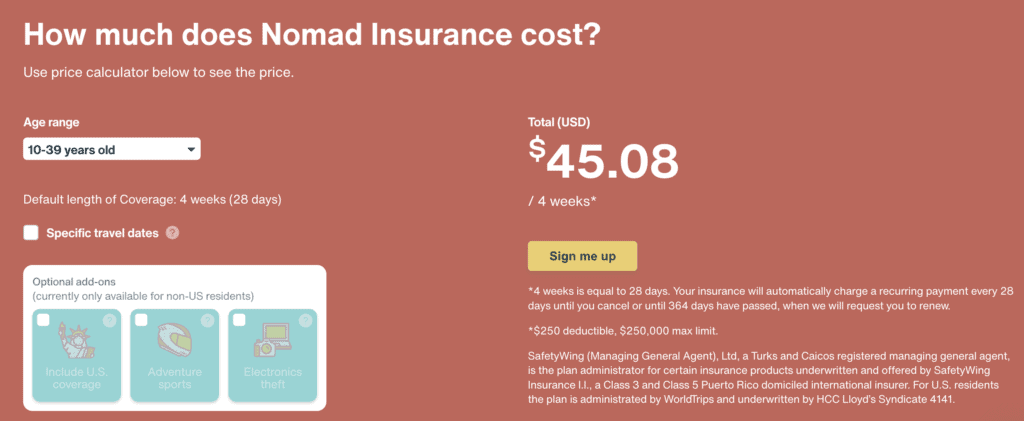

If you’re aged between t 10 and 39, SafetyWing Nomad Insurance has crunched the premiums to a figure that’s less than a fancy dinner: a cool $45.09 USD for a 4-week span (and yes, by their calendar, 4 weeks equals 28 days).

The Subscription Model, Because Life’s Not Static

Here’s the kicker: SafetyWing treats your insurance like your Netflix subscription. It automatically renews every 28 days, keeping you covered without the hassle of reminders. Think of it as binge-covering your travels. But it’s not an endless season—after 364 days, they’ll poke you to hit the renew button.

The Breakdown

Got that deductible? Just $250 USD.

Maximum limit? Like I mentioned before—$250,000 USD.

When America’s on the Agenda 🇺🇸

If you’re adding Uncle Sam’s backyard to your trip, that price tag goes up to $83.44 USD for the same 4-week period. Because healthcare in the land of stars and stripes is like ordering the supersized meal—it costs extra.

For the Daredevils and Digital Nomads 🪂

Now, if you’re the type who can’t resist jumping off things with a parachute or diving into caves, the adventure sports add-on is your golden ticket. It bumps you up to $93.44 for every 28-day cycle. And for those who can’t live without their tech toys, tack on electronics theft coverage for a total of $103.44 USD, safeguarding your gadgets alongside your limbs.

User-Friendly Pricing Calculator

But hey, if you’re not in the 10-39 club, don’t sweat it. SafetyWing’s got a nifty pricing calculator on their website. Punch in your age, sprinkle in your desired add-ons, and voilà, you’ll get your price without having to navigate a labyrinth of numbers. Check it out here!

So, whether you’re a minimalist traveler or you carry your life in your backpack, SafetyWing’s flexible pricing and automatic renewal mean one less thing to worry about. You can focus on the important stuff—like whether to have gelato or ice cream (or both) as you roam the streets of Rome.

Remember: this isn’t just spending—it’s investing. Investing in peace of mind and the “just-in-case” on your trips..

Looking Back: Woulda, Coulda, Shoulda

My close encounter with the ground in Vietnam was a stark lesson: you can’t predict when a herd of goats might cross your path, but you can gear up for life’s curveballs. That’s where SafetyWing Nomad Insurance 2.0 comes in, offering a robust safety net for travelers. It equips you with comprehensive coverage and a claims process.

Would I do things differently? You betcha. I’d pick SafetyWing from the get-go and maybe take it slower on that bike. Adventures are way more fun when you’re not worrying about what happens after you crash.

What did I learn? Get the right insurance; it’s your adventure’s safety net. And for all you solo travelers, share your location with someone. Because sometimes it’s not just about you—it’s about the peace of mind for the people who care about you. These days, I prep a little more, plan a little better, and ride a lot safer.

This isn’t about being invincible; it’s about being smart. SafetyWing provides a solid backup for those moments when the unexpected happens, without the fluff. So, keep your focus on the adventure ahead, knowing the practicalities are covered.

Whether you’re navigating the urban maze of Marrakech or catching air on a Costa Rica zip line, you need insurance that keeps up. SafetyWing offers that. It’s not an endless safety net – if you’re under two weeks old or over the hill at 70, you’re outside the coverage zone, and it won’t cover the health issues you’ve packed with you from the start. But for everything unexpected, it’s there.

This insurance is my go-to for global coverage in 175+ countries. The best part? I’m in the driver’s seat, deciding when my policy kicks in and out. And for an adrenaline junkie like me, their expanded coverage for adventure sports and electronics theft is a game-changer.

So, for all you solo explorers, entrepreneurial spirits, and storytellers, SafetyWing 2.0 is the silent travel partner you didn’t know you needed. The world’s a playground and the potential adventures are limitless.

Don’t just take my word for it. See for yourself how SafetyWing can be your financial first aid kit on your next escapade. Get all the juicy details here!